What Really Drives Start-up Success?

This blog will dig into one of the biggest studies ever done on what makes businesses grow and what holds them back. Aforementioned article analyzed data from 50 million American companies to uncover which factors truly predict long-term success.

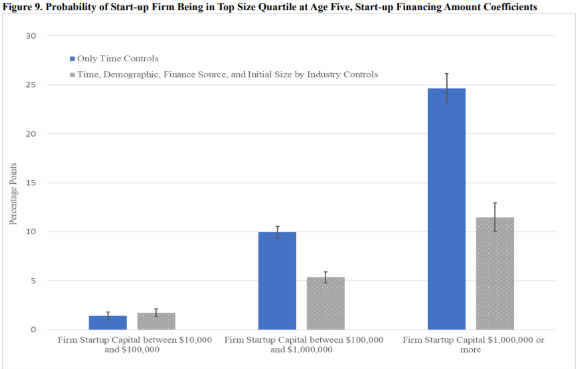

You’ve probably heard a hundred takes on what makes a company successful – great leadership, killer product, strong team culture, etc. The study found that one factor towers above the rest: money. Specifically, how much funding a company raises before it even launches. It turns out that starting with $1 million in capital boosts the odds of success by a staggering 25%.

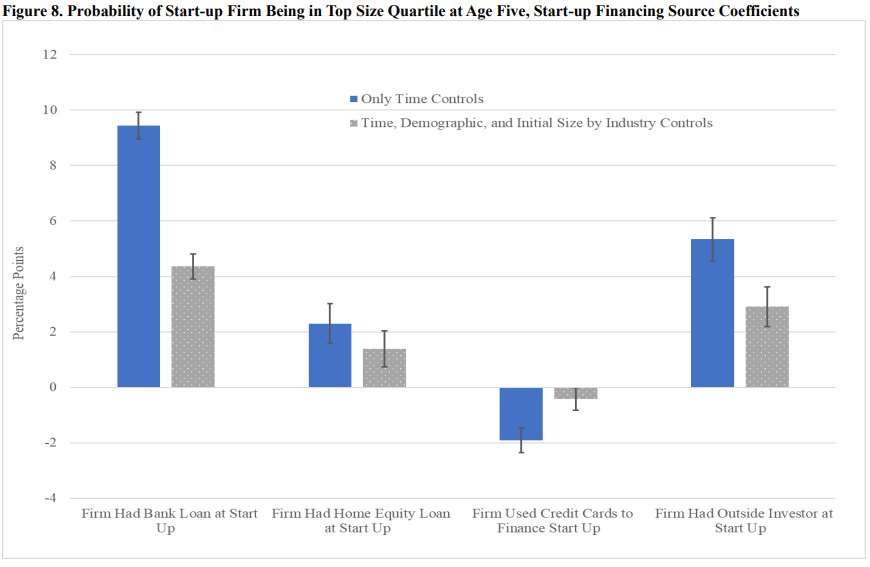

How You Fund Your Start-Up Matters – A Lot

Recent data (see table underneath: figure 8) reveal something every entrepreneur and investor should know: the source and amount of your start-up financing can significantly shape your growth trajectory. The study saw the odds of start-ups funded by bank loans scaling into top-performing firms jump by 9+ percentage points. Even outside investors backing boosted success chances by 5+ points. Furthermore, home equity loans added a 2- point edge. However, not all capital is created equal. Start-ups leaning on credit cards faced nearly a 2-point drop in their probability of success.

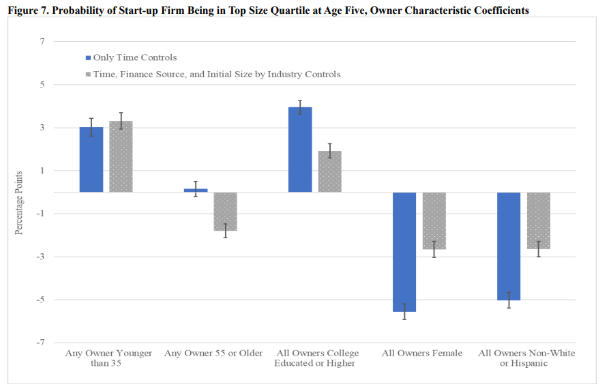

Who Owns the Business Matters – And It’s More Than Just the Idea

Figure 7 dives into the powerful link between owner characteristics and the odds of building a successful, high-growth start-up. It shows that start-ups with at least one owner aged 35 or younger are 3% more likely to become top performers by year five – and this edge holds even as more controls like industry and initial size are added. But the story doesn’t stop there. After accounting for those same controls, having an owner aged or older actually lowers the chances of success by almost 2%. Education also seems to be an interesting variable as college-educated founders were found to be significantly more likely to lead thriving firms. Gender and ethnicity also seem to have an effect: teams made up of entirely women or non-white/Hispanic owners face notably lower odds of reaching that five-year milestone at the top.

Other interesting insights

One of the key insights from the study is the conclusion that access to capital is everything, while it’s not evenly distributed. Women and non-white founders are far less likely to receive outside investment and are therefore more likely to self-finance with high-risk methods like credit cards. Secondly, the research shows that young, fast-growing companies aren’t growing like they used to. In 1981, 15% of Americans worked at companies under 4 years old. But that’s only the case for just 9% in 2022. This goes hand in hand with the big companies getting bigger – tech giants like Google and Meta aren’t just dominating; they’re buying up the most promising start-ups before they can grow. IPOs are down and acquisitions are up.

Related content

You may be interested in this articles too