- Home

- Failure stories

- VC-Backed vs Non-VC-Backed Start-up Failures

VC-Backed vs Non-VC-Backed Start-up Failures

The topic of this blog is about the world of start-up failure rates — specifically comparing VC-backed versus non-VC-backed companies. A recent article from the Financial Times revolved around start-up failure rates, which is also a topic covered by researchers Puri and Zarutskie (2012) in one seminal paper comparing VC-backed versus non-VC backed start-up life dynamics.

Status quo

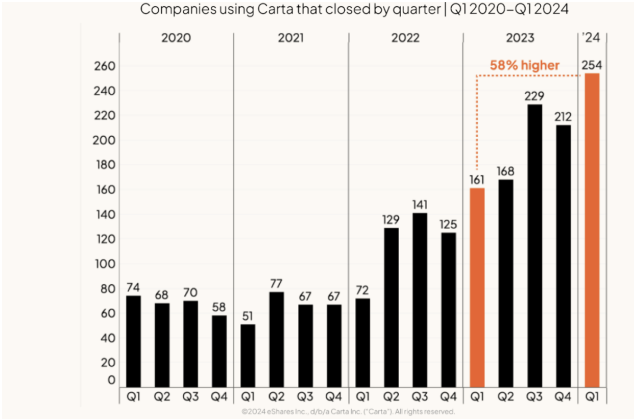

The rise in start-up failures has been quite sharp in recent years. In fact, U.S. bankruptcies jumped by 60% over the past year alone according to the article in the Financial Times. Several causes can explain these figures: a tech boom from 2021 to 2022, the rising interest rates in the following years 2022-2023, the collapse of Silicon Valley Bank, and a general slowdown in venture capital (VC) investments, to name a few. A report from Carta indicates that 254 of their VC-backed clients went bankrupt in the first quarter of 2024. That’s a huge jump from 74 failures in the first quarter of 2020.

On a more positive note, funding activity is picking back up after a two-year slump. However, the lion’s share of this funding is going toward AI start-ups, which are grabbing around 75% of all new VC funding in 2024. So, if you’re in the AI space, things are looking up! If you’re interested in alternative backed start-ups, if and how they’re staying afloat.

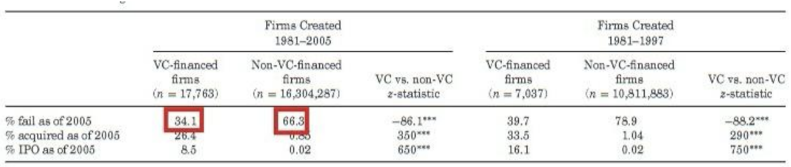

Let’s flip the coin and look at the failure rates of non-VC-backed start-ups. A study by Puri and Zarutskie (2012) reveals some interesting findings: VC-backed companies tend to be larger and focus more on scaling up than on immediate profitability. In fact, 47% of VC-backed firms start without any revenue at the time of investment. Here’s where it gets eye-opening—non-VC-backed start-ups are twice as likely to fail. Between 1981 and 2005, 34.1% of VC-backed firms failed, whereas a whopping 66.3% of non-VC-backed start-ups met the same fate.

VC vs. non-VC

VC-backed firms also have a much higher chance of achieving successful exits: 26.4% get acquired and 8.5% go public. Instead, only 0.85% of non-VC backed firms get acquired and 0.02% go public. The difference can be explained by the financial support, expertise, and resources that VCs bring to the table, helping start-ups navigate those critical early stages. However, after this initial phase, the difference in failure rates between VC and non-VC-backed companies starts to even out. To conclude, this data shows a clear pattern in terms of support and long-term potential for VC-backed start-ups, but it’s also clear that funding doesn’t guarantee success — especially when you’re in the later stages.

Related content

You may be interested in this articles too