The rise and fall of unicorns

A recent report from Dealroom (2024) highlights the impressive rise (and fall) of unicorns — ventures valued over 1 billion dollars. Below we’ll delve deeper into how these ‘unicorns’ are created and where they are located:

-

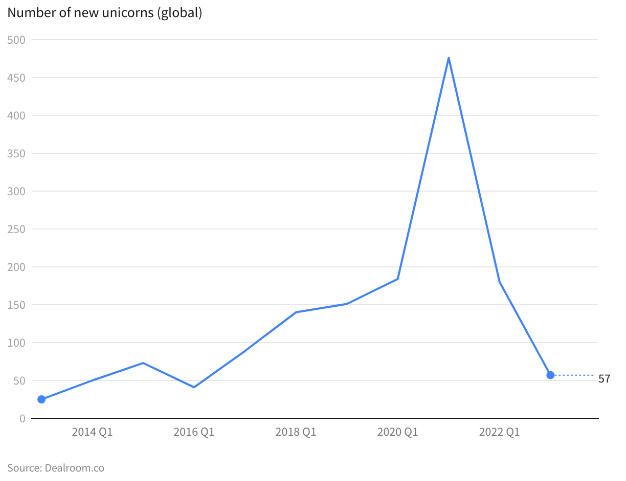

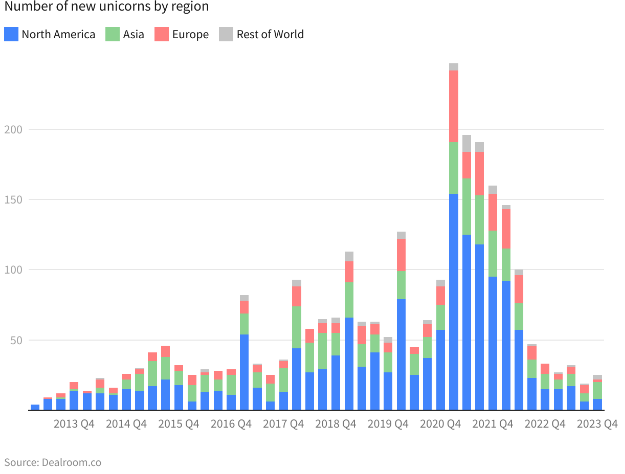

Global Unicorns – Rise and Fall

More than 2,800 private companies have achieved +$1 billion valuations since 2000. Most of those companies reached such valuations in recent years, with a peak in 2021 (+450 new unicorns). Those valuations were ‘reachable’ in a 0%-interest economy, yet, once economic policy tightened, numbers went down significantly with ‘just’ 57 new unicorns in 2023. Geographically, North America largely dominates the creation of new unicorns.

-

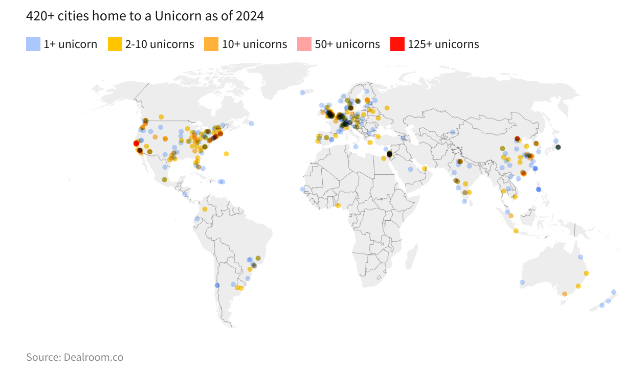

Global Unicorn Hotspots

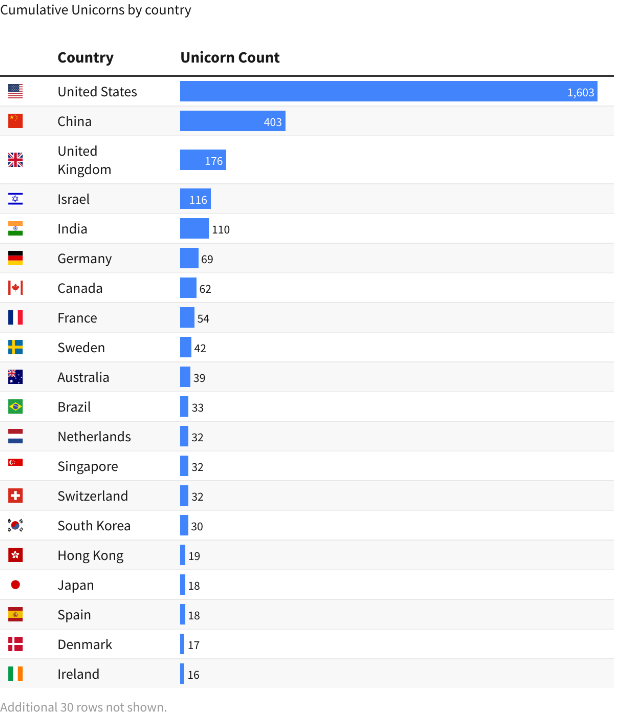

Over 420 cities have been home to newborn unicorns since the year 2000, with key hubs like San Francisco, New York, Beijing, and Tel Aviv leading the rankings (see darkest points in the map). The (right) bar chart shows the U.S dominating the global scene with 1,603 unicorns born, followed by China, the UK (big London hub), Israel (Tel Aviv hub), and India.

In their report Dealroom 2024 tracks the current state of unicorns in different geographies. While concentrated in a few global hubs, these billion-dollar ventures continue to shape the start-up ecosystem.

Related content

You may be interested in this articles too